When you visit our Give to Your Community and Fund Your Project pages, you’ll see that there are so many ways to give back to your community, or to receive funding to help you make your community a better place to live.

Resources

The resources below provide some background information about giving. Please contact a professional advisor or contact us directly if you have questions or if you’d like to discuss giving options. We’re here to help!

Learn how the Community Foundation provides many choices for giving.

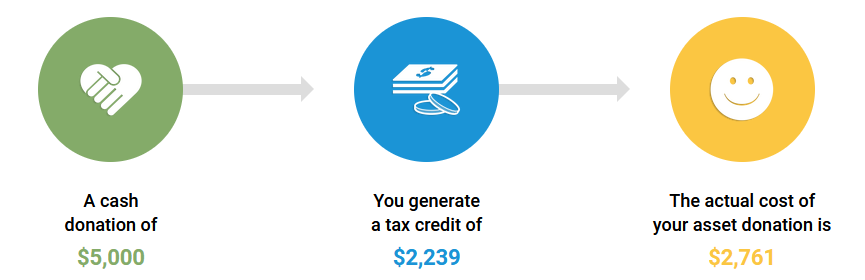

A Donation Calculator

Plug numbers into this calculator to learn the tax benefits of a donation, based on your income and the amount you choose to give. You can also look at the power of your donation and the growth of your endowment over time.

Check out the Donation Calculator here (Note: you will be taken to a 3rd party website that we have licensed.)

Donating Shares

Donating shares in-kind is one of the best ways to support a charity. The direct transfer of shares allows you to avoid capital gains tax that would be triggered if you were to sell shares and realize a gain on your investment. The process is also very simple and easy to navigate.

Here are the steps:

- The Donor or their broker completes our Letter of Direction and Authorization form (this ensures we are aware of the transaction).

- Our transfer agent is Aviso Financial Inc. The broker completes the Credential Charitable Donation of Securities in Kind form and either sends the form through directly to Credential or to us. If the broker sends the form to us, we send it directly to Connor, Clark & Lunn Private Capital (CC&L) and they manage communication with Credential.

- We provide a receipt for the value of the shares on the day they are received into our investment account. CC&L tells us when the shares are received and gives us the official price to receipt for. The transfer can take anywhere from 2 days to 2 weeks, but usually only a few business days.

Bequest/Wills

The Community Foundation would be pleased to assist you with the process of refining giving language in your will, no matter what charity you choose to support. After all, our mission is to increase the level of giving in our region.

When considering a gift to charity in your estate, it is important to make sure that the language in your will:

- accurately reflects your wishes

- clearly and accurately identifies the charities you wish to support

There are some common pitfalls associated with gifts to charity that should be considered:

- Is the name of the charity accurate?

- What happens if the charity doesn’t exist when you die?

- Do you want to provide specific instructions for your gift? For example, is the gift to be used only for a capital project? Is it to be endowed? Or do you want to allow the charity to make the best investment of your gift at the time?